To make sure you’re getting the best deal on workers’ compensation insurance is to get multiple quotes. We can help by bringing you three agents to compete for your policy. They compete and you save!

How much does workers’ compensation insurance cost?

It’s hard to place a price tag on workers’ compensation insurance. There are four big factors that contribute to how much you’ll pay.

- What type of business you run

- Where your business is located

- How much you pay your employees

- Which insurance company you choose

Workers’ Comp Insurance Cost by Industry Type

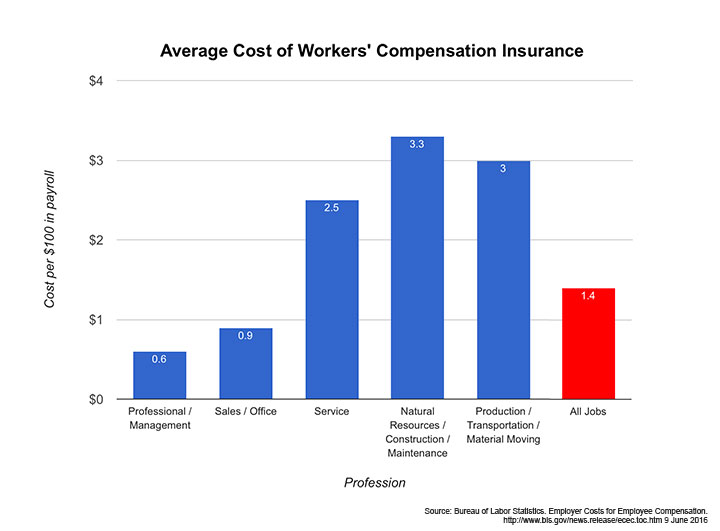

The biggest factor that affects your workers comp insurance cost is the industry you’re in. Workers comp insurance agents use a complex system of classification codes to figure out how much to charge you. There are hundreds of these classification codes, each with their specific rate. And most insurance companies like to keep their rates secret.

But they are certain signposts you can look at to figure out how much you’ll pay for workers comp. One way is to look at averages based on general industries. As you might have guessed, office jobs are cheaper to insure than construction jobs. The average cost across all industries is $1.40 per $100 in payroll.

Now, these are averages, so they should be taken with a grain of salt. If you want exact numbers, you need to contact your state’s worker compensation board. They will often have rates listed by classification code (like this pdf put out by the Washington State department of labor).

Workers Comp Rates by State

Each state has its own rules and regulations governing workers compensation laws. Many states have their own exchanges where you can buy workers comp from the state directly. Looking at state data is another way to estimate the amount your business will pay. We’ve included the average rates by state in the table below.

| State | Cost/$100 payroll | State | Cost/$100 payroll |

|---|---|---|---|

| Alabama | $1.19 | Montana | $2.49 |

| Alaska | $2.74 | Nebraska | $1.37 |

| Arizona | $0.89 | Nevada | $0.98 |

| Arkansas | $0.80 | New Hampshire | $1.28 |

| California | $1.85 | New Jersey | $1.36 |

| Colorado | $0.95 | New Mexico | $1.50 |

| Connecticut | $1.15 | New York | $1.41 |

| Delaware | $1.24 | North Carolina | $1.19 |

| Florida | $1.27 | North Dakota | $1.57 |

| Georgia | $1.16 | Ohio | $1.01 |

| Hawaii | $1.43 | Oklahoma | $2.22 |

| Idaho | $1.63 | Oregon | $1.16 |

| Illinois | $1.34 | Pennsylvania | $1.51 |

| Indiana | $0.86 | Rhode Island | $1.10 |

| Iowa | $1.64 | South Carolina | $1.82 |

| Kansas | $1.25 | South Dakota | $1.35 |

| Kentucky | $1.16 | Tennessee | $1.13 |

| Louisiana | $1.61 | Texas | $0.75 |

| Maine | $1.48 | Utah | $0.94 |

| Maryland | $1.07 | Vermont | $1.83 |

| Massachusetts | $0.76 | Virginia | $0.77 |

| Michigan | $0.99 | Washington | $1.39 |

| Minnesota | $1.07 | West Virginia | $1.85 |

| Mississippi | $1.36 | Wisconsin | $1.77 |

| Missouri | $1.11 | Wyoming | $1.85 |

Workers Compensation Cost as a Function of Total Wages

You might have noticed that insurance companies price workers compensation coverage a little different than other types of coverages. You don’t pay a fixed yearly rate. Instead, you pay a percent of your workers’ total wages. So as your small business grows and you add new employees and give old employees raises, you will notice that your workers’ compensation rates will increase as well.

Different Insurance Companies Have Different Prices

The first three factors that help determine your rate are largely out of your control. What is in your control is the diligence with which you search for a good insurance company. Different companies have different rates and they often have discounts for small businesses and businesses with good credit history.

We’ve made comparing workers compensation insurance companies easy. Just fill out one form and we connect you with three agents who compete for your business. They send you their best price and you choose the plan that works for you.